Rumored Buzz on Clark Wealth Partners

Unknown Facts About Clark Wealth Partners

Table of ContentsEverything about Clark Wealth PartnersThe Best Strategy To Use For Clark Wealth Partners9 Easy Facts About Clark Wealth Partners DescribedThe 6-Minute Rule for Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.The smart Trick of Clark Wealth Partners That Nobody is DiscussingExamine This Report on Clark Wealth Partners

The globe of money is a complicated one. The FINRA Foundation's National Capacity Research Study, for instance, just recently located that virtually two-thirds of Americans were incapable to pass a standard, five-question monetary proficiency test that quizzed participants on topics such as interest, financial obligation, and various other fairly standard ideas. It's little marvel, then, that we commonly see headings lamenting the poor state of most Americans' funds (financial advisors Ofallon illinois).Along with handling their existing clients, economic advisors will typically invest a fair quantity of time each week conference with prospective clients and marketing their solutions to retain and expand their company. For those taking into consideration coming to be a financial advisor, it is essential to consider the typical salary and task security for those operating in the area.

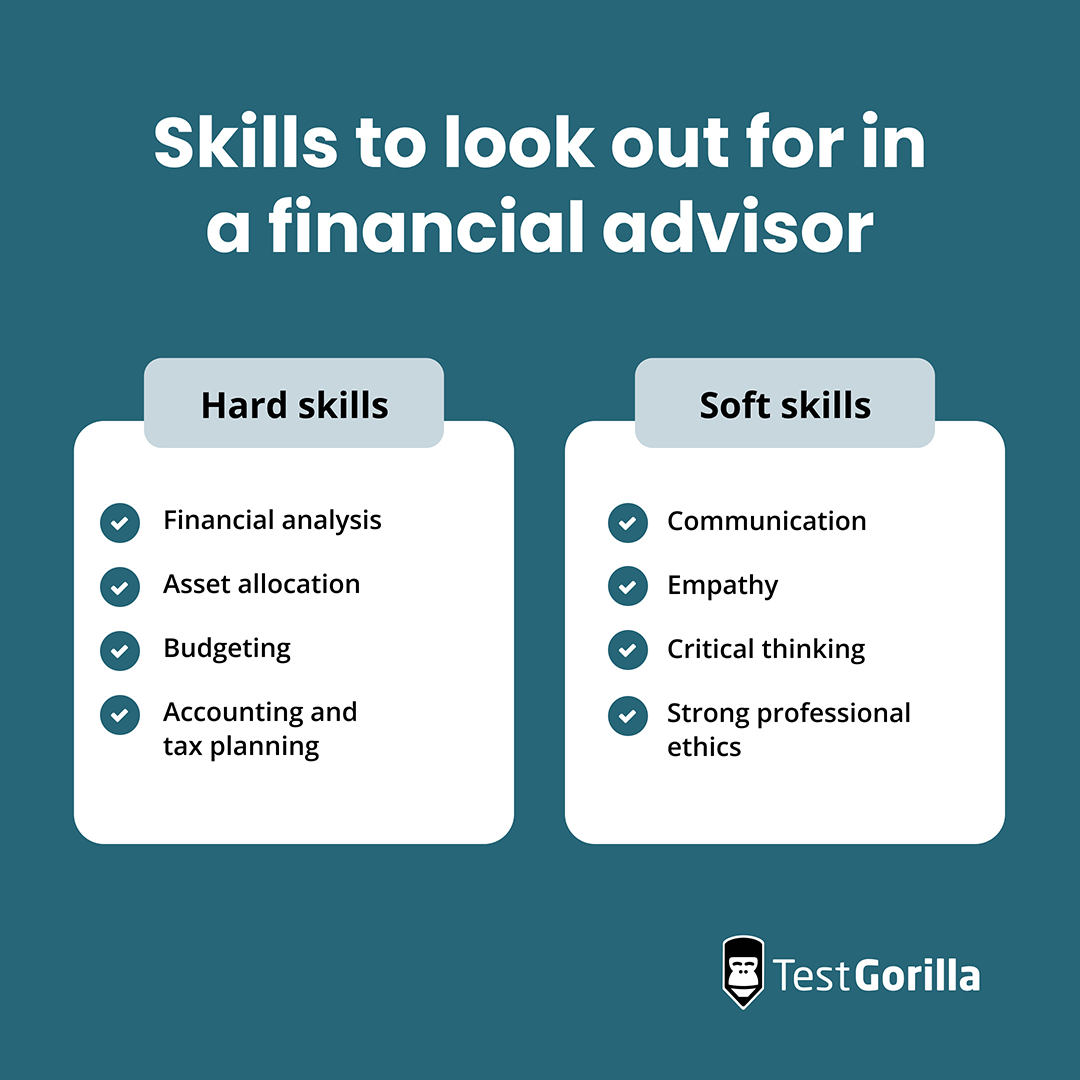

Courses in taxes, estate preparation, investments, and danger monitoring can be valuable for pupils on this path too. Depending on your distinct occupation objectives, you might also need to make particular licenses to fulfill certain customers' demands, such as getting and offering stocks, bonds, and insurance coverage policies. It can additionally be useful to make an accreditation such as a Licensed Monetary Coordinator (CFP), Chartered Financial Expert (CFA), or Personal Financial Expert (PFS).

Facts About Clark Wealth Partners Revealed

Lots of people determine to obtain assistance by utilizing the services of a financial professional. What that resembles can be a variety of points, and can vary depending upon your age and phase of life. Prior to you do anything, research study is crucial. Some people worry that they require a particular amount of money to spend prior to they can get help from an expert.

How Clark Wealth Partners can Save You Time, Stress, and Money.

If you haven't had any kind of experience with an economic expert, right here's what to expect: They'll begin by supplying a comprehensive evaluation of where you stand with your assets, obligations and whether you're fulfilling benchmarks compared to your peers for financial savings and retirement. They'll evaluate short- and long-term objectives. What's valuable about this action is that it is individualized for you.

You're young and working full-time, have an auto or 2 and there are trainee loans to settle. Right here are some feasible concepts to aid: Establish good cost savings routines, pay off financial debt, set standard goals. Pay off trainee loans. Relying on your career, you might qualify to have part of your institution car loan waived.

Getting My Clark Wealth Partners To Work

You can discuss the following finest time for follow-up. Financial experts typically have various tiers of prices.

You're looking ahead to your retired life and helping your kids with greater education and learning costs. A financial consultant can supply advice for those circumstances and even more.

The Of Clark Wealth Partners

That could not be the best way to keep structure wealth, particularly as you progress in your occupation. Set up routine check-ins with your coordinator to modify your strategy as needed. Stabilizing savings for retirement and college costs for your youngsters can be tricky. A financial consultant can help you prioritize.

Thinking of when you can retire and what post-retirement years might resemble can produce problems concerning whether your retirement cost savings are in line with your post-work strategies, or if you have saved enough to leave a heritage. Aid your economic specialist recognize your technique to money. If you are a lot more conservative with saving (and prospective loss), their ideas need to react to your fears and problems.

Things about Clark Wealth Partners

As an example, intending for wellness treatment is just one of the big unknowns in retirement, and a monetary specialist can describe options and recommend whether added insurance coverage as defense may be useful. Prior to you start, attempt to get comfy with the concept of sharing your whole economic image with a professional.

Offering your specialist a complete image can help them develop a plan that's prioritized to all components of this link your monetary standing, specifically as you're quick approaching your post-work years. If your funds are easy and you have a love for doing it yourself, you may be great on your own.

A monetary expert is not only for the super-rich; anybody facing significant life changes, nearing retired life, or sensation overwhelmed by economic choices might gain from expert assistance. This post checks out the duty of financial consultants, when you might require to seek advice from one, and vital considerations for selecting - https://peatix.com/user/28420248/view. An economic consultant is a qualified expert who assists clients manage their finances and make informed decisions that align with their life objectives

The Clark Wealth Partners Statements

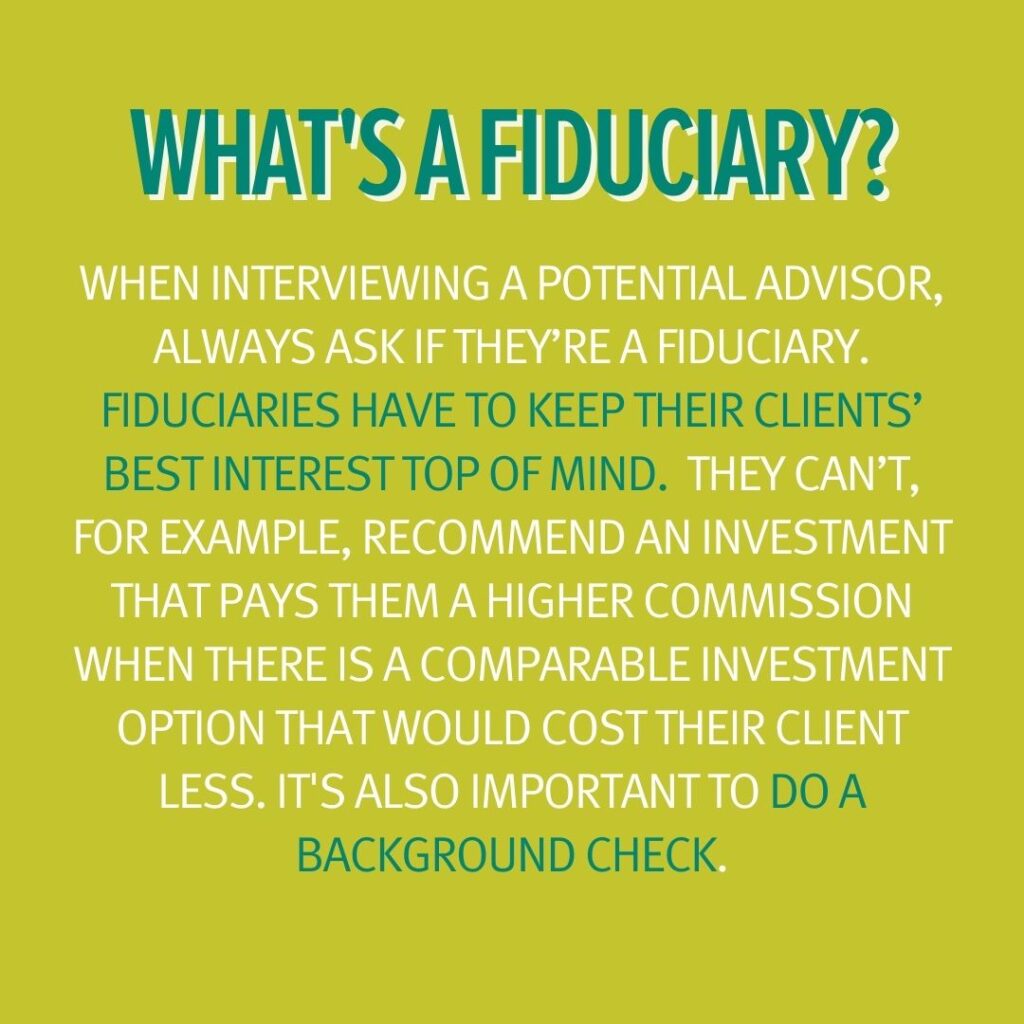

In contrast, commission-based advisors gain revenue with the monetary products they offer, which may influence their suggestions. Whether it is marital relationship, separation, the birth of a child, career changes, or the loss of a liked one, these occasions have unique monetary ramifications, usually needing timely choices that can have lasting impacts.